About

The Method

NOTE: I'm interested in comments and suggestions for how to improve the message. What would make it more compelling to sign up for a service which provides the information described here on a weekly basis? What unanswered questions come to you when reading this? What would you think a stock investor, especially one just starting out, would want to pay for this service? The form and art are shown here are for general layout purposes only. I'm working on improving the text itself.

What is it?

We comb through the daily history of thousands of stocks to find those which have delivered the best return while also being the most predictable. From this list, we look at the individual companies to see if their current growth, earnings, stock price, and recent performance are in line with expectations. If a stock passes all these tests, then it's put on the list for your consideration. When you look at this list, you'll know you are starting with stocks that have outperformed the market, with less volatility.

This means you only need to look at a few good stocks to find the ones you feel comfortable owning. It lets you identify good stocks that you might ordinarily miss because no other site gives you this information as easily.

Let's look at a couple of examples.

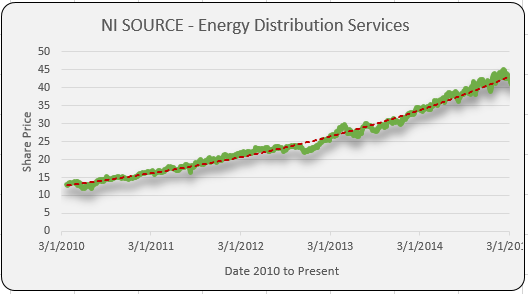

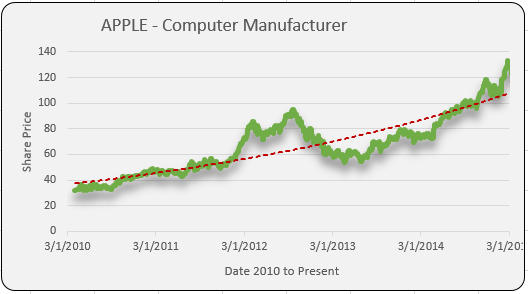

The red dotted line in these charts is what the value of the stock would be if it had gained exactly the same amount every day over a 5 year period. This would be the ideal situation.

If the stock followed this curve exactly, and no changes are made to the business practices or management, then one can reasonably expect the future gains will be the same. In reality, of course, stocks do deviate from the ideal curve, and you can easily see this in the green share price fluctuations. But this is a great example because it has very nearly the same gains, year after year, like clockwork.

Additionally, this stock with solid, consistent gains grew 235% over the past 5 years, while the stock market as a whole gained 80%. Your money would have grown almost twice as fast had you subscribed to our list.

Here is a 5 year chart for Apple. Everybody knows this company, and it has been doing well for many years. However, one thing you will notice is how unpredictable it can be. In 2013 it lost nearly half its value!

These swings are due to the very nature of Apple's business. If a new product is well received, like the new iPhone, then Apple does well. If the product is a flop or there are management changes, the stock drops. Over a 5 year period it gained an incredible 296%, but at the cost of increased volatility.

If you are disciplined enough to trust Apple, then you would have better gains than with NI Source, but NI Source produces more predictable gains, with stellar returns. If you are tempted to sell a stock just because it has large swings, then your peace of mind is better served by investing in a more predictable stock like NI Source or the many others we find for you. Apple is by no means the top gainer, either. The top spot from our list gained a whopping 662% over the same 5 year period.

This approach is based on sound investing principles.

You know the stock market is the best way to get great returns on your investment money. According to CNN Money, over the long term, stocks have historically outperformed all other investments. Stocks have historically provided the highest returns of any asset class -- close to 10% over the long term. The next best performing asset class is bonds. Long-term U.S. Treasurys have returned an average of more than 5%.

One measure of a good performing stock portfolio is to compare it to the S&P 500. Unfortunately, in a recent report, just 26% of domestic stock-fund managers were able to deliver higher returns than their respective index benchmark over the past five years through June 2014, according to S&P Dow Jones Indices. Even more sobering, in this same bullish period, 87% of large-cap stock-fund managers failed to beat the S&P 500.

We provide the data you need, when you need it.

In the past, it was fairly straightforward: you give your money to a money manager or broker, and let them use their skills to invest it for you. Fund managers charge a fee for doing this.

But many people who used to invest in mutual funds this way are now switching to other strategies because history shows that the fund managers aren't choosing better stocks than you can pick on your own.

If you are like most people, you would like to easily find good stocks and invest in them. However, identifying consistently well performing stocks requires time and experience. Learning how to select excellent performing stocks is not a skill easily acquired. Can you hope to achieve a level of competency equal to the professional fund managers? Even if you did, is that good enough, considering they generally can't even match the S&P 500 average returns?